A New Shield for Nepal's Economy: Parametric Insurance and Its Prospects, Article of Susil Dev Subedi

- Susil Dev Subedi

- 2025 Nov 21 14:01

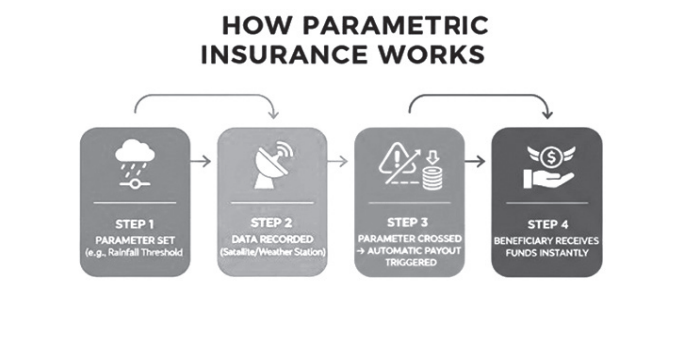

Kathmandu.Parametric or Index-based Insurance is a risk transfer mechanism that provides payouts based on the occurrence of a specific event or parameter, rather than on the actual loss incurred. It is an innovative financial instrument designed to provide rapid and predictable payouts after climate-related disasters. Unlike traditional indemnity insurance, which compensates for assessed damages, parametric insurance triggers payouts automatically when predefined environmental or climatic parameters such as rainfall, temperature, or wind speed reach or exceed a specified threshold (World Bank, 2020). This mechanism contributes to climate change mitigation and adaptation by enhancing financial resilience, encouraging risk reduction, and promoting sustainable recovery in vulnerable regions.

Unlike traditional indemnity models, parametric insurance doesn't require the need for on-site damage verification. Once the agreed-upon parameters such as sub-threshold rainfall, seismic magnitude or wind speed are triggered, the payout is executed without delay. Commonly utilized indices include precipitation levels, ambient temperature, river discharge, wind intensity and seismic activity, all of which are objectively measurable and widely applicable across diverse geographies.

At its core, parametric insurance is predicated on the principle of pre-agreed compensation linked to quantifiable indicators, rather than reimbursement of actual losses. This structural design facilitates expedited, transparent, and cost-efficient claim settlements by eliminating the logistical complexities associated with individualized damage inspections. As noted by institutions such as the World Bank and OECD, this model significantly enhances operational efficiency and financial agility in disaster response.

The key features of parametric insurance make it a powerful and efficient risk transfer mechanism, particularly suitable for climate and disaster-prone economies. It operates on objective triggers measurable indices such as rainfall levels, temperature, wind speed, or seismic activity that determines when payouts are made. This ensures that claim settlements are fast and automatic, as payments are released immediately once the pre-agreed parameter threshold is reached. The approach significantly reduces administrative costs because it eliminates the need for on-site loss assessments and complex claim verification procedures. Moreover, parametric insurance enhances transparency and predictability, since both the insurer and the insured clearly understand the insurance conditions that trigger compensation. These features make it especially valuable for low-income and disaster-prone populations, providing quick financial relief after shocks and helping vulnerable communities recover and rebuild more effectively.

Characteristics of Parametric (Index-Based) Insurance

Parametric insurance, also called index-based insurance, is distinct from traditional indemnity-based insurance because it relies on objective, measurable triggers rather than the actual loss suffered by the insured. Its core characteristics are summarized below:

1. Predefined Trigger Mechanism

In parametric insurance, payouts are not based on the actual damage experienced by the insured, but rather on specific, measurable indicators that are agreed upon in advance. This means that when a certain environmental or climatic condition such as rainfall, temperature, wind speed, or earthquake magnitude reaches or exceeds a set threshold, the insurance payment is triggered automatically.

For example, imagine a farmer in Nepal who has purchased parametric crop insurance. The policy states that if rainfall during the planting season falls below 50 millimeters (for example only), the farmer will receive a payout. Once official meteorological data confirms that rainfall was below the threshold, the compensation is released without the need for field inspections or lengthy paperwork. Similarly, if an earthquake of magnitude 6.0 or higher strikes a region, insured households or businesses may receive immediate financial support based on seismic data alone.

This mechanism ensures that claims are settled quickly, transparently, and efficiently. Both the insurer and the insured clearly understand the conditions under which payments will be made, reducing uncertainty and enabling better financial planning. In a disaster-prone country like Nepal, such predefined trigger systems can play a vital role in accelerating recovery and building resilience against future shocks.

2. Objective and Transparent Data Sources

The triggering data come from independent, verifiable, and trusted sources such as meteorological stations or satellite observations, ensuring fairness and transparency (OECD, 2021).

3. Rapid Claim Settlement

Since payouts are based on parametric triggers rather than physical loss assessment, settlements are fast and efficient, reducing liquidity stress for policyholders especially after natural disasters (International Association of Insurance Supervisors [IAIS], 2019).

4. Reduced Administrative and Transaction Costs

Because on-site verification is unnecessary, the operational cost of underwriting and claim settlement is significantly lower than that of conventional insurance (OECD, 2021).

5. Suitable for Catastrophic and Weather-Related Risks

Parametric products are best suited for climate-related, agricultural, and catastrophic events where traditional insurance is either too costly or impractical due to widespread and correlated losses (IAIS, 2019).

6. Encourages Financial Resilience

By providing quick liquidity post-disaster, parametric insurance enhances resilience and recovery capacity of individuals, businesses, and governments (OECD, 2021).

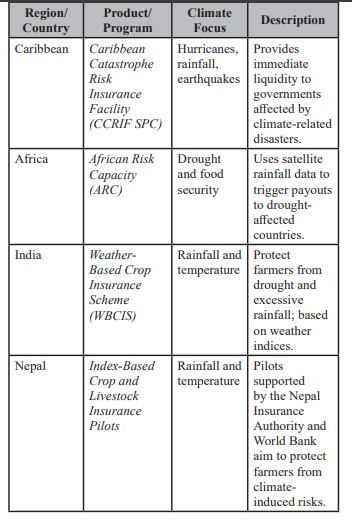

Global Context and Rationale of Parametric Insurance

- Parametric insurance has become a global instrument for climate resilience and disaster risk financing. Examples include:

- African Risk Capacity (ARC): Covers drought and food security.

- Caribbean Catastrophe Risk Insurance Facility (CCRIF): Earthquake, hurricane, and excess rainfall.

- Pacific Catastrophe Risk Assessment and Financing Initiative (PCRAFI): Similar regional pool for Pacific nations.

- These models show how regional risk pools and government participation can stabilize post-disaster recovery and complement social protection systems.

Role of Parametric Insurance In Climate Change Mitigation and Adaptation

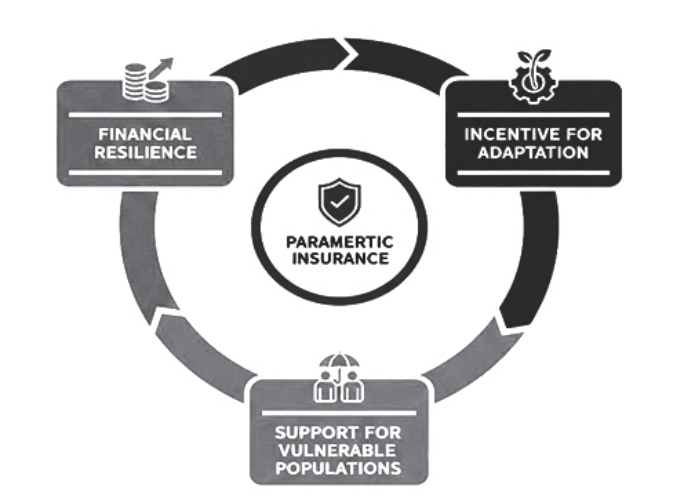

Parametric insurance supports climate risk management in three major ways:

a. Financial Resilience and Risk Transfer

It allows governments, communities and businesses to transfer climate-related risks (e.g., floods, droughts, cyclones) to insurance or reinsurance markets. This helps avoid fiscal shocks and ensures quick liquidity for recovery efforts after extreme events (OECD, 2021).

b. Incentive for Climate Adaptation

By linking payouts to measurable climate indices, parametric insurance encourages data-driven risk management and investment in adaptation measures such as irrigation systems, resilient agriculture and early warning infrastructure (Surminski et al., 2016).

c. Support for Low-Income and Vulnerable Populations

It is particularly useful in developing and climate-vulnerable countries, where small farmers and microenterprises often lack access to traditional insurance. Index-based products provide affordable protection and promote climate-resilient livelihoods (Greatrex et al., 2015).

Some Global Examples of Adoption of Parametric Insurance

Benefits In Climate Change Context

- Provides timely financial assistance after climate shocks.

- Reduces government fiscal burden following disasters.

- Enhances community-level resilience and promotes climate-smart agriculture.

- Facilitates access to reinsurance and catastrophe bonds for national disaster risk financing.

Limitations of Parametric Insurance

- Basis risk: Payout may not perfectly match actual loss.

- Data dependency: Requires reliable and high-quality climate data.

- Limited awareness: Farmers and small enterprises may lack understanding of index-based products.

2. Relevance of Parametric Insurance In The Nepalese Context

a. High Climate and Disaster Risk Exposure

Nepal's geographic and climatic diversity exposes it to hydro-meteorological hazards, including erratic rainfall, drought, floods, and glacial lake outburst floods (GLOFs). Parametric insurance, which pays based on measurable climate parameters, is therefore highly relevant for managing such systemic risks efficiently (OECD, 2021).

b. Agricultural Vulnerability and Rural Livelihoods

Agriculture employs about 60% of Nepal's population and contributes nearly 25% of GDP (Ministry of Agriculture and Livestock Development [MoALD], 2022). Traditional crop insurance schemes face challenges of loss assessment and moral hazard, whereas index-based products such as rainfall or temperature-based crop insurance offer faster and more transparent protection for farmers against weather-induced losses (World Bank, 2020).

c. Disaster Risk Financing for Government and Communities

The Government of Nepal, through the National Disaster Risk Reduction and Management Authority (NDRRMA) and Ministry of Finance, has been exploring parametric insurance mechanisms to complement national disaster risk financing strategies. These instruments can provide quick liquidity for emergency response following earthquakes or floods (UNDP, 2021).

d. Support for Inclusive and Microinsurance Programs

Under the leadership of the Nepal Insurance Authority (NIA) and Insurance Institute of Nepal (IIN), several pilot programs on index-based agriculture and livestock insurance have been introduced in collaboration with development partners. These initiatives aim to extend affordable coverage to smallholder farmers, cooperatives and microenterprises-key pillars of Nepal's inclusive insurance and financial inclusion agenda (NIA, 2023).

e. Alignment with National Climate and Development Goals

Parametric insurance aligns with Nepal's Climate Change Policy (2019) and National Adaptation Plan (NAP, 2021) by providing market-based risk transfer solutions that complement public disaster relief. It also supports Nepal's commitment to the Sendai Framework for Disaster Risk Reduction (2015-2030) and the UN Sustainable Development Goals (SDGs) especially SDG 13 (Climate Action) and SDG 1 (No Poverty).

Key Benefits of Parametric Insurance for Nepal

- Rapid claim settlement after disasters.

- Reduced administrative burden and moral hazard.

- Increased financial resilience for farmers, MSMEs, and local governments.

- Enhanced collaboration between insurers, reinsurers, and development agencies.

- Data-driven adaptation planning through meteorological and satellite-based indices.

Existing Initiatives in Nepal

a. Agriculture and Livestock Index-Based Pilots

Nepal Insurance Authority (NIA), with support from UNDP, World Bank, and UNCDF, has piloted index-based crop and livestock insurance.

Examples:

- Rainfall Index Insurance for paddy and maize in selected Terai districts.

- Livestock mortality index schemes linked to temperature and disease data.

b. Parametric Disaster Insurance

Government of Nepal, through the Ministry of Finance and Disaster Risk Reduction and Management Authority (NDRRMA), has explored parametric flood and earthquake insurance frameworks. World Bank's CAT DDO (Catastrophe Deferred Drawdown Option) incorporates such triggers.

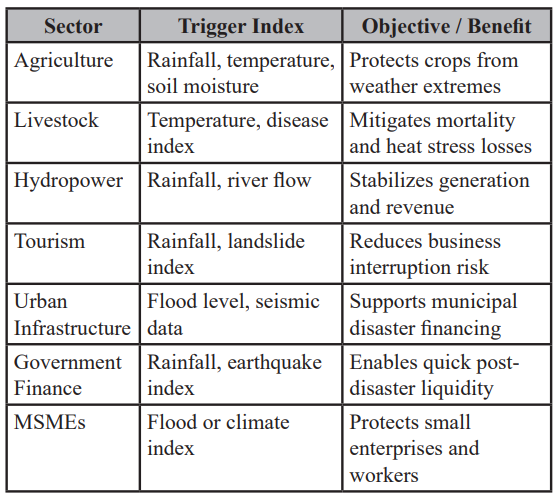

Potential Application Areas in Nepal

Key Potential Application Areas

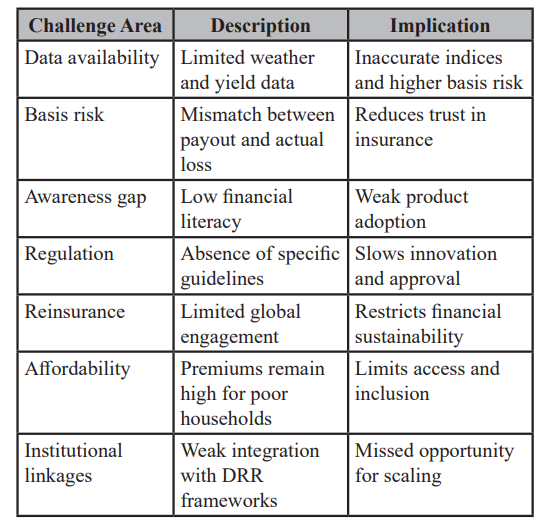

Challenges of Parametric Insurance in Nepal

Way Forward

As Nepal continues to face increasing climate-related risks and natural disasters, the need for innovative financial instruments like parametric insurance has become more urgent than ever. Its ability to deliver fast, transparent and data-driven payouts makes it a powerful tool for building resilience among vulnerable communities and sectors. However, to fully harness its potential, coordinated efforts are required across policy, infrastructure, capacity building and regional cooperation. The following strategic actions outline a practical way forward to institutionalize and expand parametric insurance in Nepal:

- Strengthen the institutional framework under the Nepal Insurance Authority to develop clear guidelines and regulatory standards for parametric insurance products.

- Invest in data infrastructure such as weather stations, satellite-based remote sensing and hydrological modeling to ensure reliable and timely trigger data.

- Promote public-private partnerships to launch pilot projects that demonstrate the effectiveness of parametric insurance in real-world scenarios.

- Align parametric insurance with national social protection programs and disaster risk financing strategies to ensure broader coverage and impact.

- Build technical capacity through specialized training programs offered by institutions like the Insurance Institute of Nepal and universities.

- Foster regional collaboration by exploring SAARC-level risk pooling mechanisms to share resources and reduce collective vulnerability.

- Integrate parametric insurance into Nepal's broader disaster risk financing framework to ensure it complements existing financial preparedness tools.

- Enhance reinsurance arrangements and international cooperation to strengthen financial backing and global support for parametric schemes.

- Leverage digital technology and FinTech solutions to improve product delivery, data collection, and customer engagement.

These steps, if pursued collectively, can help Nepal establish a strong parametric insurance ecosystem that supports rapid recovery, financial stability and long-term climate resilience.

References

Asian Development Bank. (2022). Climate risk insurance and disaster resilience in South Asia. ADB Publications. Greatrex, H., Hansen, J. W., Garvin, S., Diro, R., Blakeley, S., Le Guen, M., Rao, K. N., & Osgood, D. (2015). Scaling up index insurance for smallholder farmers: Recent evidence and insights. CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS). https://hdl. handle.net/10568/53101

International Association of Insurance Supervisors. (2019). Issues paper on the role of insurance in supporting disaster risk reduction. IAIS. https://www.iaisweb.org

Ministry of Agriculture and Livestock Development. (2022). Statistical information on Nepalese agriculture Government of Nepal. 2021/22.

Nepal Insurance Authority. (2023). Annual report 2022/23. Publications. Kathmandu: NIA

Organisation for Economic Co-operation and Development. (2021). Enhancing financial resilience against disasters: The role of insurance and other financial instruments. OECD Publishing. https://doi. org/10.1787/27cb59b2-en

Organisation for Economic Co-operation and Development. (2021). Financial management of catastrophe risks (p. 75). OECD Publishing.

Surminski, S., Bouwer, L. M., & Linnerooth-Bayer, J. (2016). How insurance can support climate resilience. Nature Climate Change, 6(4), 333-334. https://doi.org/10.1038/nclimate2979

United Nations Development Programme. (2021). Financing climate resilience through innovative insurance mechanisms in Nepal. UNDP Nepal Country Office.

World Bank. (2020). Agriculture index insurance: Principles and practice. World Bank Group.

World Bank. (n.d.). Introduction to index insurance [Online course description]. https://www.worldbank.org/en/olc/course/43842

“Writer Susil Dev Subedi is the Executive Director of the Nepal Insurance Authority. This article is from the special 89th Anniversary Publication of Nepal Bank.”

![$adHeader[0]['title']](https://www.bfisnews.com/images/bigyapan/1759825227_1100x100.gif)

प्रतिक्रिया